22 August 2016

The Pension Protection Fund produces a monthly index update (this article has data taken as at end-July 2016) of the estimated funding position of the defined benefit schemes which would be potentially eligible for entry into the Fund.

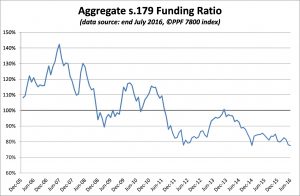

It’s been a while since I last reviewed this data (my last – December 2014 – update is available here: Where did the deficit come from? – a study in scarlet (ink)) and it’s interesting to see how things have changed since then. The aggregate PPF 7800 funding ratio has declined from 82.3% at the end of 2014 to 77.5% at the end of July 2016.

Most major growth markets are higher now than at the end of 2014 so it’s no particular surprise that the main culprit is the ongoing decline in gilt yields. To give one example, this chart shows the 10 year gilt yield decline over the past five years:

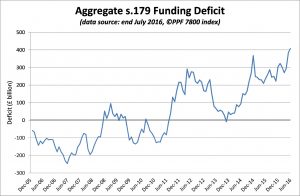

Less often noted is the sharp increase in funding deficit. Gilt yield decreases increase the currently value of liabilities so, even if a scheme’s funding ratio remained unchanged (typically via LDI hedging), the funding deficit will also have risen – and this increases the burden that the scheme places on the employer and hence the scheme’s reliance on covenant. The aggregate PPF 7800 funding deficit increased from £266bn at the end of 2014 to £408bn at the end of July.

Original report and analysis is provided by the PPF on their website