28 February 2014

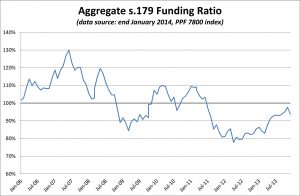

The Pension Protection Fund produces a monthly index update (this month’s release has data taken as at end-January 2014) of the estimated funding position of the defined benefit schemes which would be potentially eligible for entry into the Fund.

Growth asset levels declined slightly during January – the traditional post-Christmas bounce was short-lived this year! – though long gilt yields declined slightly. This combination led to a small decline in eligible scheme funding with the average universe funding ratio declined from 97.6% to 93.7% reflecting an increase in overall deficit from £27.6bn to £76.4bn.

Report and analysis is provided by the PPF on their website