20 January 2015

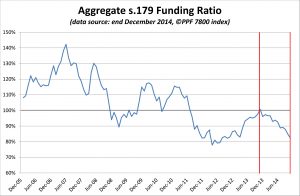

According to Pension Protection Fund (PPF) data((http://www.pensionprotectionfund.org.uk/Pages/PPF7800.aspx)), the s.179 funding level for the aggregate universe of DB schemes potentially eligible for entry into the PPF fell sharply during 2014. According to their database, the aggregate funding position moved from a small surplus (0.8% at Dec 13) to a significant deficit (-17.7% at Dec 14).

So where did all this red ink((Apologies to fans of Sherlock Holmes)) come from?

Well … conventional growth assets may not have helped much. Trustees will be familiar with the roll-forward phenomenon on actuarial valuations; that the selected discount rate becomes a sort of ‘hurdle rate’ going forward – if asset growth doesn’t keep pace, then the funding ratio will slip back. The FTSE All-Share index((FTSE equity and bond returns source: http://www.ftse.com)) made a modest total return (including dividends but gross of any fees) of 1.2% in the year. Diversified overseas investment would have done rather better – a hedged investment in FTSE All-World xUK would have made 5.6% – rather higher if left unhedged.

The villain, as ever, seems to be the quiet, unassuming gilt markets sitting quietly in the corner. Bloomberg’s 30yr conventional gilt index yield fell by 1.2% over the year – translating this into cash returns, the FTSE Actuaries UK Conventional Gilts Over 15yr index made just over 26% in the year! Even the Conventional Over 5yr index put on almost 20% and the Index-Linked Over 5yr did slightly better.

This would obviously have helped schemes holding gilts but the big impact was on the assessed current value of liabilities. Even schemes with quite a high level of interest rate and/or inflation cover would have seen some impact but an equity growth portfolio combined with a bond-like liability structure would have made for a challenging 2014.

For completeness, the PPF database does also note the small impact of new actuarial assumptions the PPF adopted in April – these led to a deficit change of just over £8m – just over 0.6% decline in funding ratio.