As the initial auto enrolment (“AE”) deadlines approach, we thought it worth touching on a few interesting (tricky?) points that pension schemes, employers and trustees should bear in mind.

![]() Update available as PDF download (click the icon or go to my Library).

Update available as PDF download (click the icon or go to my Library).

- Many employers will feel that existing schemes will be suitable for auto-enrolment purposes. However, eligibility is not merely a matter of minimum contribution rates (the AE hurdle is, in any case, fairly undemanding) or investment choice : an existing scheme must also comply with all of the intricate eligibility, operational and administration criteria;

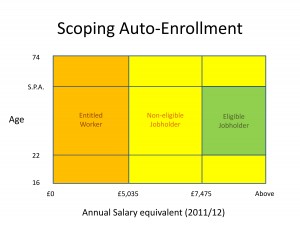

- The new pensions legislation is not just about the “eligible jobholder” (green in the diagram above) who must be automatically enroled. Employers must also consider the “non-eligible jobholder” (yellow above) who can also insist on being enroled and the “entitled worker” (orange above) who can insist on getting some pension provision though not necessarily in the AE scheme;

- AE is all about continued maintenance throughout the employee’s career. For instance, schemes will have to monitor and manage:

- employee recruitment,

- changing financial boundaries for AE eligibility

- changing status of the employee between the three eligibility classes

- timetabling the three years re-opt-in process for eligible opt-outs

- interaction with flex schemes and salary sacrifice

- interplay with pension protection arrangements;

- It will be unlawful to circumvent the intentions of AE hence, for instance, the following will not be lawful:

- contracting out the employee from the AE regime, even with agreement

- offering inducements to opt-out from AE or to transfer back to an existing scheme

- discrimination against employees or prospective employees on the basis of their pensions arrangements.